May 10, 2025

Fliqa’s AIS unifies everything from account ownership checks to transaction insights. Whether you’re a lender, insurer or neobank, tap into a single source of truth for faster, data-driven decisions, enhanced with AI technology.

Step 1

User authorization

User grants permission to share account data

Step 2

Fliqa Ecosystem

API securely transfers account data

AI-powered risk engine enriches and analyzes data

Step 3

Partner Platform

Data is delivered in near real-time

Insights are used for financial decision-making

AIS gives financial institutions and fintechs secure, real-time access to users’ account data across multiple banks and accounts.

With automated categorization, risk scoring, and trend identification, you gain actionable insights that accelerate onboarding, underwriting, and compliance processes —all while maintaining stringent PSD2 and GDPR standards.

AIS advantages

Risk Scoring

Multi Banking

Onboarding

Risk Scoring

AI-Enhanced Risk Evaluation

Enhanced and optimized risk scoring solution that will provide optimised services for your customers and speed up the process of loan applications.

Multi Banking

Real-Time Account Snapshot

Eliminate guesswork — know your user’s exact financial position anytime.

Onboarding

Account Ownership Verification

Accelerate credit decisions and compliance processes.

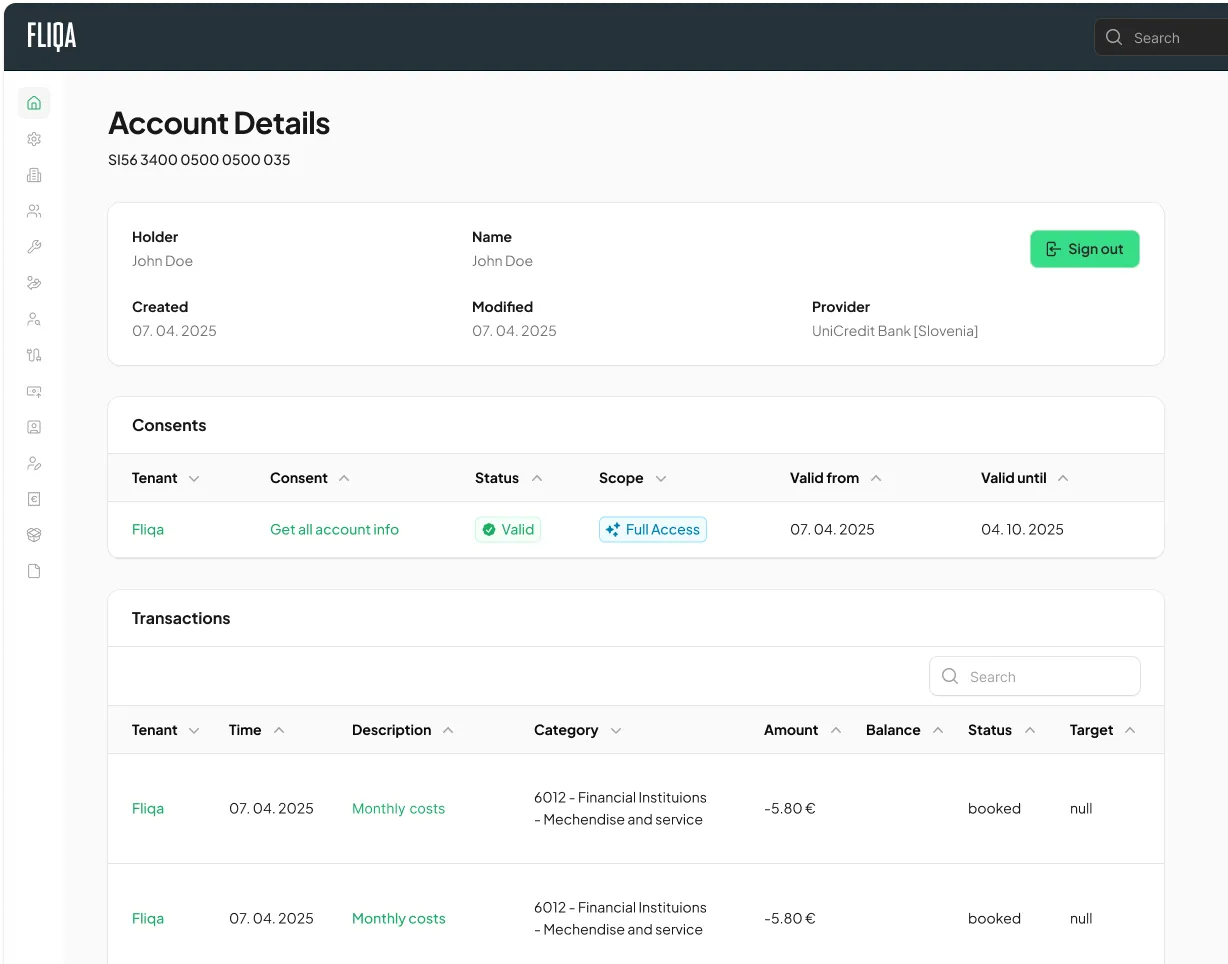

The Fliqa Console

Transaction monitoring, user data management, account oversight, and product configurations in a single, intuitive web interface. Gain real-time visibility and manage workflows with ease, all within a scalable and secure environment.

Compliance &

Security Assurance

Zero Hassles.

Fully PSD2, GDPR Compliant

Fliqa’s robust encryption and SCA measures ensure every transaction meets the highest security standards.