December 08, 2025

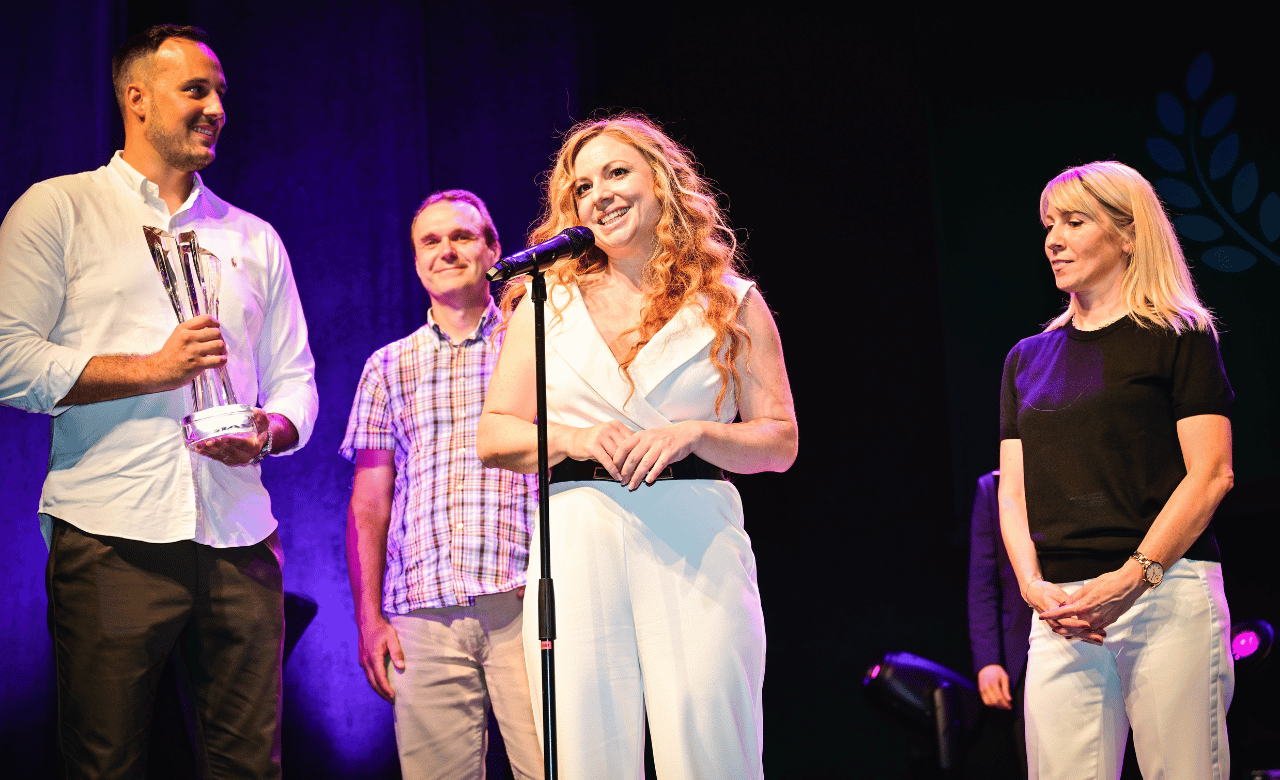

Fliqa, a Ljubljana-based fintech company specializing in open banking solutions, has been honored with the title of Slovenian Start-up of the Year 2024. The award was presented during a ceremony at the Si-TI Theater in Ljubljana, attended by over 250 stakeholders from Slovenia’s entrepreneurial ecosystem. This accolade, now in its 17th year, is organized by Start:up Slovenia in collaboration with the Slovene Enterprise Fund, the Ministry of the Economy, Tourism and Sport, and other key ecosystem partners.

Fliqa’s recognition stems from its development of two innovative open banking products. The first facilitates direct, secure payments from users’ bank accounts, eliminating the need for traditional credit card transactions. The second is a platform that enables merchants to assess customers’ credit risk in real time through advanced algorithms, streamlining the credit approval process.

The company’s solutions are notable for their modular design, ease of API integration, compliance with regulatory standards, and robust data protection measures. Fliqa has established strategic partnerships with several European banks and fintech firms, including Slovenia’s SRC and Dutch company IbanXS.

The selection process for the award involved a jury of seven experts evaluating five finalists—Fliqa, Plan Z, Remea, TipPri, and DDD Invoices—based on market validation, investment acquisition, team competencies, and potential for rapid international growth. Jury member Rok Zorko of Silicon Gardens emphasized the importance of scalability, stating that the ideal start-up should have the potential to achieve $100 million in sales.

Upon receiving the award, Fliqa’s CEO and co-founder, Nina Strajnar, expressed pride in the team’s dedication and cohesion, highlighting the collective effort invested over the years to achieve this milestone.

Fliqa’s recognition as Slovenian Start-up of the Year 2024 underscores its significant contributions to the fintech industry and its potential for continued growth and innovation in the open banking sector.